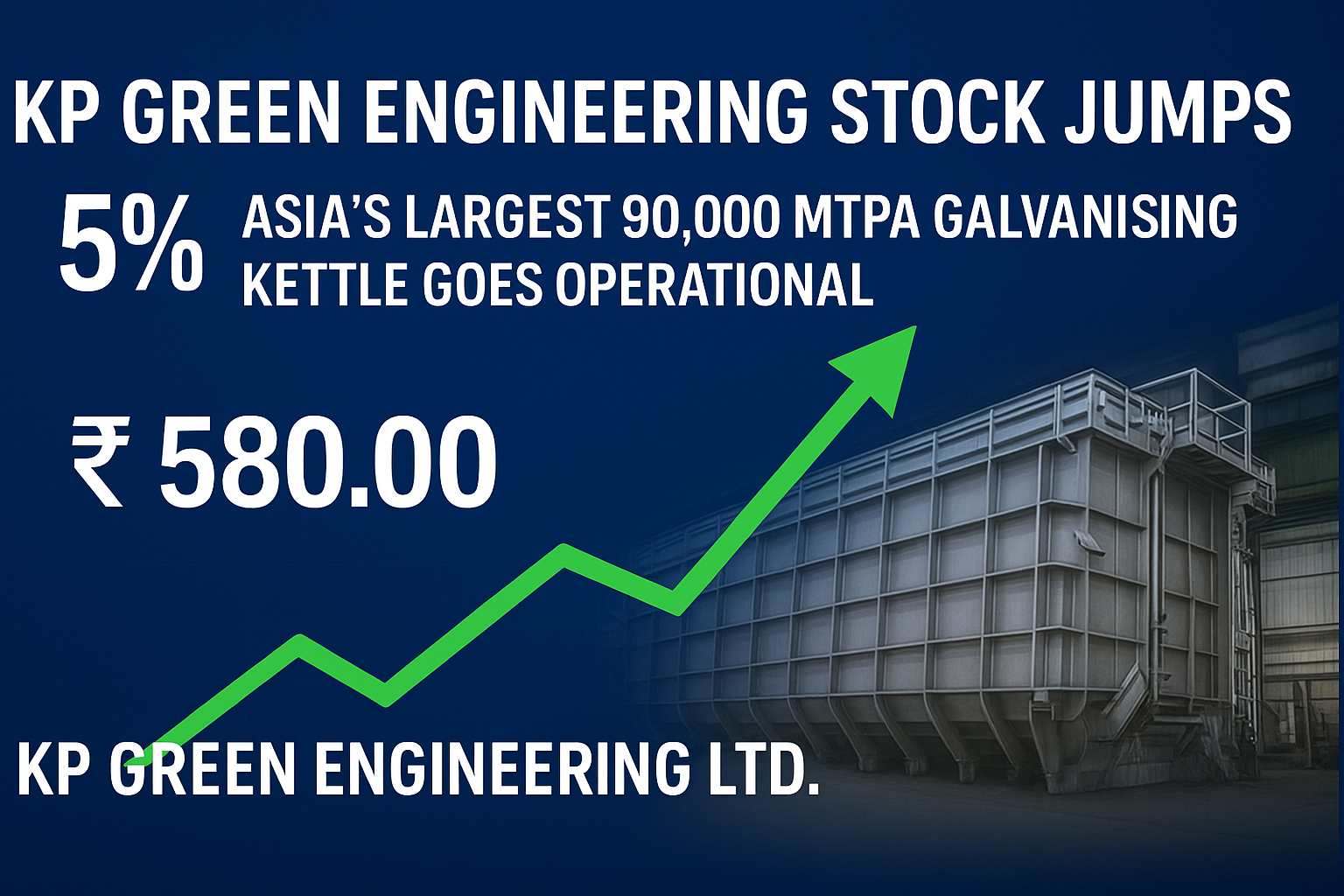

The Indian stock market witnessed a notable development as KP Green Engineering Ltd., part of the KP Group, saw its share price surge by 5% after commissioning Asia’s largest galvanising kettle with a capacity of 90,000 metric tonnes per annum (MTPA). The breakthrough at its Matar unit in Gujarat has sparked investor optimism, positioning the company as a frontrunner in galvanisation and engineering solutions.

This milestone not only marks a significant achievement in industrial engineering but also highlights the company’s long-term growth strategy in India’s rapidly expanding infrastructure and renewable energy sectors.

What Triggered the Stock Rally?

On August 23, 2025, KP Green Engineering officially announced the operational start of its state-of-the-art galvanising kettle, imported from Germany. Measuring 14 meters in length, 3 meters in width, and 3.8 meters in depth, the equipment is capable of handling 1,100 tonnes of zinc at a time.

This development instantly translated into investor confidence. The stock, which had been trading at around ₹564.20, rallied to ₹580, touching an intraday high of nearly ₹592.40. Over the past three trading sessions alone, KP Green’s shares have gained more than 13%, showcasing robust bullish momentum.

Why Is the New Galvanising Kettle a Game Changer?

1. Massive Capacity Expansion

The Matar plant’s galvanising capacity has now jumped by 90,000 MTPA, adding to its earlier capacity of 36,000 MTPA. KP Green’s total installed galvanising capacity now exceeds 142,500 MTPA, with another 168,000 MTPA under commissioning, expected to go live in FY 2026.

2. Improved Efficiency & Scale

The kettle’s advanced design allows the company to undertake large-scale, high-volume projects with greater speed and efficiency, catering to infrastructure and renewable energy clients.

3. Strengthening Market Leadership

With this milestone, KP Green has established itself as Asia’s largest player in galvanisation, outpacing regional competitors. This positions the company strongly in domestic as well as export markets.

Stock Market Snapshot

Here’s a quick look at KP Green Engineering’s stock performance as of August 22–23, 2025:

- Closing Price: ₹580.00

- Previous Close: ₹564.20

- Day’s Range: ₹571.10 – ₹592.40

- 52-Week Range: ₹340 – ₹768.85

- 6-Month Return: +31.31%

- 1-Year Return: +17–19%

- Market Capitalisation: ~₹2,900 crore

- Price-to-Book Ratio: ~8.7–9.0

These figures highlight a consistent upward trajectory for the stock, particularly in the last six months.

Broader Industry Context

The galvanisation industry plays a critical role in infrastructure, power transmission, and renewable energy projects, where corrosion-resistant steel structures are essential.

With India focusing on smart cities, renewable energy, and large-scale infrastructure development, demand for galvanisation is poised to rise significantly. KP Green’s move to commission the largest galvanising kettle in Asia is thus a timely and strategic investment, aligning with government priorities.

Investor Sentiment & Market Outlook

1. Rising Investor Confidence

The 5% surge in share price reflects strong investor confidence in KP Green’s capacity expansion and future earnings potential. Analysts suggest that such a capacity boost could translate into higher revenues and profit margins, making the stock attractive for both institutional and retail investors.

2. Medium-to-Long Term Growth Drivers

- Increased capacity to meet large project orders

- Potential for export opportunities in galvanised products

- Alignment with India’s renewable energy and infrastructure boom

3. Risk Factors to Watch

While the outlook is positive, investors should also consider challenges such as:

- Fluctuations in zinc prices

- Competition from regional players

- Execution risks in ramping up new capacities

Financial & Business Strength

Beyond galvanisation, KP Green Engineering is involved in fabrication, renewable energy solutions, and engineering projects. The company’s diversified portfolio provides a cushion against cyclical risks.

With a market cap of nearly ₹2,900 crore and steady growth in revenue, KP Green has emerged as a mid-cap stock with strong growth potential.

What This Means for Retail Investors

For investors, the commissioning of Asia’s largest galvanising kettle signals:

- Strong business fundamentals – The expansion directly adds to the company’s revenue-generating capacity.

- Attractive mid-cap growth story – With consistent returns over 6 months (+31%), KP Green offers a compelling growth trajectory.

- Potential re-rating – If revenue growth matches expectations, the stock could see an upward revaluation by analysts.

Expert Views

Market experts believe KP Green Engineering is well-positioned to benefit from India’s “Make in India” and infrastructure-led growth story. With the government emphasizing steel, highways, metro rail, renewable energy, and transmission networks, the demand for galvanisation is expected to remain strong for years.

Conclusion

The 5% surge in KP Green Engineering stock is not just a market reaction but a reflection of the company’s strategic capacity expansion and industry leadership. By commissioning Asia’s largest 90,000 MTPA galvanising kettle, KP Green has sent a strong message to competitors and investors alike — it is here to dominate the galvanisation sector.

With steady financials, increasing capacity, and alignment with India’s growth story, KP Green Engineering has become a stock to watch for long-term investors seeking exposure to the infrastructure and engineering sector.